June 27, 2016

Many investors chase high returns and therefore are always on a lookout for best performing mutual funds. They excitedly invest in the funds that have given maximum returns in last 1/3/5 years. Within months, they are tempted to change these existing funds if they find some other fund more attractive. This frequent switching of funds seldom creates wealth over long term as frequent switching means more exit load, higher taxation and unstable, randomly created portfolio.

Rather than focussing only on best performing funds and trying to maximise returns, seasoned investors and experienced advisors understand the virtue of Asset Allocation to generate consistent, long term superior risk adjusted returns.

Asset Allocation means investing some part of money in different category of investments i.e. debt, balanced, large cap and midcap funds.

Why Asset Allocation

Nothing is more important than appropriate asset allocation of investments for generating long term, consistent returns. Over different market cycles, different kinds of funds perform the best. The 8-9% returns of debt funds may look better when the stock markets are down and equity funds are in negative. In another scenario of small caps and midcaps giving exceptional returns, just like they have in last 2-3 years, large cap funds and balanced funds may seem unattractive.

Investors run the risk of allocating major portion of their investments in the theme that has already played out partially or fully, leading to higher expectations but lower or negative future returns. Therefore, asset allocation should form an important part of investment process. Asset allocation among various kind of funds like debt, balanced, midcap and large cap may be planned as per one’s financial goals. The financial goal may be a specific Family Goal, Age based goal, Target Return goal or Asset Allocation goal.

The allocation of money to various kinds of funds assures the investor that he is always allocated to themes that are working well in the market. Being always present in the performing theme is more important than not being in the theme at all.

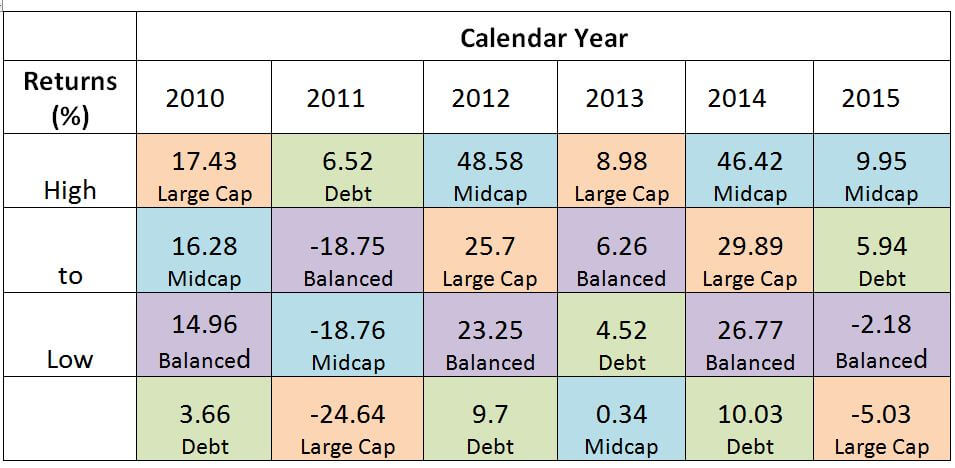

The below table shows how different kind of investments have performed in various calendar years.

* Benchmarks Considered

As can be seen from the above, in every calendar year, the returns generated by different category of investments vary with respect to each other. Hence, their rankings also change. In none of two years, the same sequence follows. Since 2010, large cap has given the highest returns in 2010 and 2013 but has been the worst performer in 2011 and 2015. Midcap has given best returns in 2012,2014 & 2015 calendar years but has grossly underperformed in 2013.

It is evident that if an investor invests only in the best performing funds at a time (which obviously will be part of same category), his investments may grossly underperform in the coming years. Whereas, a properly diversified portfolio with appropriate asset allocation shall make sure that he is always invested in performing categories.

Conclusion

For long term wealth creation, attractive returns on investments are as important as the consistency of returns. Consistency in returns motivates the investor to allocate more money to his investments and also increases his commitment to remain invested for long. Larger allocation of money, coupled with attractive, consistent returns, invested for longer period of time truly creates exceptional wealth. Even a small investment of Rs. 5000 per month invested for 20 years @ 16% returns creates 74 lac rupees fund. Amazing. Isn’t it? So let’s focus on asset allocation and create wealth to meet our future financial needs, with peace of mind.

Happy Investing!

Pawan Agrawal is the founder and managing partner of Investguru. You may reach him at pawan@investguru.in .